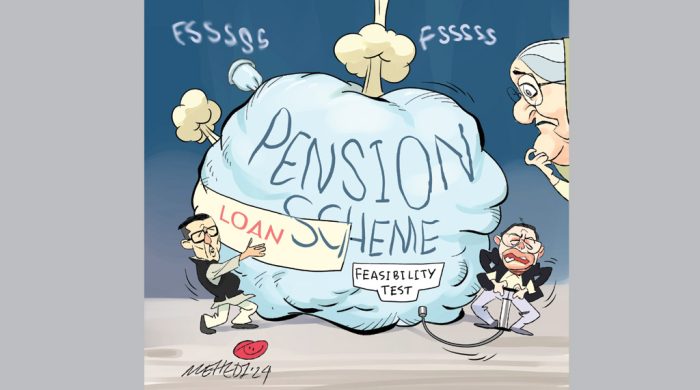

Govt plans late feasibility study

- Update Time : Tuesday, July 9, 2024

- 22 Time View

The government is going to borrow $250 million from the Asian Development Bank to implement a project for capacity building of the National Pension Authority struggling to woo clients amid lukewarm response in general and protests by university teachers.

The proposed three-and-a-half-year project, including a feasibility study, is expected to give the much-needed strength to the pension authority transitioning towards the contributory pension system from the current non-contributory one, said the finance ministry officials.

Economists have blamed the government’s lack of preparation and the absence of a feasibility study for the precarious situation unfolding around the implementation of the new pension scheme replacing the current one, borne entirely from the national budget.

The government has moved towards the contributory pension policy from the non-contributory one decidedly to offset the growing burden of pension allocations on the national budget. Within a period of just 11 years, the allocations for pension and gratuity benefits in the national budget more than tripled—for FY25 Tk 39,419 crore has been projected that was Tk 11,913 crore in FY14—mounting pressure on fiscal management by the Finance Division.

In its contributory pension initiative, the government has introduced four instruments—Probash, Pragati, Surokkha, and Samata—for citizens aged between 18 years and 50 years in August 2023.

Under the initiative the scheme holders have been projected to receive monthly pension benefits at different rates from the retirement age of 60 years based on their monthly contribution.

The new pension programme, however, drew criticism from the economists who said that the programme did not have comprehensive investment plans for the money in profitable ventures.

Moreover, its new directive effective from July 1 to bring the new entrants in around 403 public autonomous, semi-autonomous and statutory bodies in the newly designed pension instrument Prattay has faced backlashes from the university teachers.

The teachers of around 50 public universities have gone on an indefinite work abstention programme across the country, demanding cancellation of the order condemning the new pension programme as discriminatory.

‘Issuing only an order is not sufficient to replace an age-old system,’ said Policy Research Institute executive director Ahsan H Mansur.

Calling the launching of the pension scheme hasty and political, he said adding that the government should not consider it from the political angle and instead should uphold the national interest involved in the matter.

Highlighting the groundwork as crucial for such an initiative, Mansur said that the government should thoroughly discuss the rational of the scheme with all stakeholders under a clear roadmap.

The pension authority under the ministry of finance has been struggling to make the instruments popular, as only 3,32,773 citizens registered themselves with the pension authority until June by paying around Tk 97 crore, of which Tk 93 crore has been invested in the government treasury bonds.

Of the total subscribers, around two-thirds belong to Samata, a subsidised instrument designed for low earning citizens with monthly subscription fee of Tk 1,000, half of which is paid by the individual who has registered for it, while the other half is paid by the government.

The lukewarm public response to the other instruments is contrary to the expectations of former finance minister AHM Mustafa Kamal who thought the new pension programme would attract huge response from citizens, and consequently open a new source for the government to overcome the fund crunch.

The overenthusiasm without a proper feasibility study has thus backfired, opening controversies, observed former Bangladesh Bank governor Salehuddin Ahmed about the new pension scheme.

Now the government has realised the necessity of a feasibility study, he said, calling the delayed initiative ‘better than nothing’.

The finance ministry officials said that the Asian Development Bank had already shown interest to lend $250 million, while the government would contribute the rest $75 million to the $325 million project to be implemented between December 2024 and June 2028.

The planning ministry is now scrutinising the Preliminary Development Project Proforma sent by the Finance Division in the past week.

The Manila-based ADB has agreed to make the feasibility study, a vital component of the capacity building project, for a venture undertaken by the government with a vision to bring the entire population into the fold of the new pension scheme.

The feasibility study is expected to identify the loopholes hampering the implementation and provide recommendations based on the experiences in other countries, said the officials.

A plan to bring public officials and employees who are currently outside the purview of the new pension system into the system in future may also face resistance, said the finance ministry officials.

Finance minister Abul Hassan Mahmood Ali in his budget speech on June 6 said that the government officials, including bureaucrats, would be brought under a new pension scheme Shebok the next year.